SB5489 – Requires state agencies to use all practical means and measures to promote environmental justice.

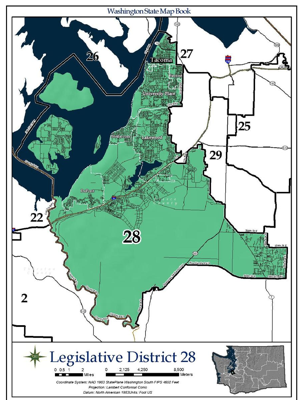

Prime Sponsor – Senator Saldaña (D; 37th District; Seattle)

Current status – Returned to Senate Rules 3rd Reading by the House; reintroduced and retained in present status for 2020 session. Failed to pass out of the Senate by cutoff; placed in the “X” file.

Next step would be – Dead bill…

Legislative tracking page for the bill.

HB2009 was an extensive revision and rewrite of the original version of this bill; the second substitute Senate bill is now pretty close to the House version.

2019 Legislative History –

In the Senate (Passed)

Had a hearing on a proposed substitute in the Senate Committee on Environment, Energy & Technology February 13th. Passed out of committee and referred to Ways and Means February 19th. Had a hearing there February 27th; a second substitute bill was further amended and passed out of Ways & Means February 28th. Placed on 2nd reading by Rules Committee March 5th. Passed the Senate March 8th.

In the House

Referred to the House Committee on State Government and Tribal Relations. Had a hearing March 19th; replaced by a striker which passed out of committee March 26th. Referred to Appropriations; had a hearing April 6th. Amended and passed out of committee April 8th. Referred to Rules; placed on 2nd reading April 10th. Still in Rules by the end of 2019 session; Returned to Senate Rules 3rd Reading by the House.

Comments –

In the House

The changes in the House striker are summarized on its last page. It shifts power back toward the task force, saying that agencies “must adopt” the use of the cumulative impact analysis, and “must adopt” it consistent with the task force’s guidance on how to use it if there is any. It specifies the use of the Department of Health’s (DOH) Washington Tracking Network for the cumulative impact analysis, rather than the UW study, and adds some reporting about needs for funding and uncompleted tasks.

Amendments in House Appropriations require the use of tribal exposure scenarios as a factor in the analysis of cumulative impact areas, have the report include best practices for local governments to include environmental justice principles in comprehensive planning under the GMA, and make the bill null and void if it isn’t funded in this year’s budget.

In the Senate

Second Substitute Senate version

This aligned the bill with the significant changes in HB2009, though it’s different in some minor ways.

Like HB2009, it now changes the central definition of “environmental justice” from “fair treatment and [a] right … to have access to a safe, healthy environment” to the “fair treatment and meaningful involvement of all people … with respect to the development, implementation, and enforcement of environmental laws, regulations, and policies.” (That is, it’s now about due process, not outcomes.)

Like HB2009, it changes the composition and power of the task force that they set up. That group no longer creates rules about defining and implementing environmental justice that state agencies must adopt. It develops models, methods, best practices, and recommendations in the House version. In the House version there are “model rules for agency adoption”; in the Senate version the task force creates “guidance for state agencies.” It also says that “if time and resources permit” the task force should do the work on equity analyses, gaps in research, utilizing the precautionary approach, and cataloging and cross-referencing all the state agencies’ research and data about people’s health and environment that are required in HB2009.

The House bill has the Governor appoint the representative of a statewide environmental justice organization to co-chair the task force. (That unspecified organization is presumably Front & Centered, the bill’s creator.) The Senate has him appoint ” a member who is well-informed on the principles of environmental justice and with expertise in statewide environmental justice issues.” They both replace four representatives living in communities with high levels of pollution with three members from some currently unspecified “organization” appointed by the co-chairs with diversity in mind. They reduce the task force’s size by dropping a tribal leader; the representatives of labor, of business, and of statewide environmental interests; and the potential representatives from each of any other agencies the Governor might add. (Since there are still representatives from eight agencies on the task force, the Governor’s appointees would have a clear majority in this revised group.)

This substitute bill does not include HB2009’s provision about including environmental justice considerations in SEPA analyses. Section 5 (1) uses somewhat different language than HB2009’s about the degree to which agencies are required to use the task force’s recommendations, but it isn’t clear to me if one of them gives the agencies more latitude than the other.

One amendment to the 2nd Substitute in Senate Ways & Means added back a tribal representative, one from business and one from labor, now appointed by the Governor.

Front and Centered has a flyer about the bill.

Summary of the original version –

Creates a task force to study and and report recommendations to the Legislature and the Governor on how to incorporate environmental justice principles into the ways state agencies operate. “Environmental justice” means that all people have the right to a safe and healthy environment; that no group of people should bear disproportionately high exposure to pollution or adverse human health or environmental impacts; and that all groups should have appropriate access to meaningful public participation in decisions that affect their environment.

Within sixty days of the task force’s report, Ecology is to provide uniform rules and guidelines for implementing the recommendations to all state agencies on the task force. The agencies must use cumulative impact analyses to identify highly impacted communities, create target environmental health standards for counties and census tracts all over the state, and prioritize highly impacted communities and their vulnerable populations in the development, adoption, implementation, and enforcement of environmental laws, regulations, policies, and funding decisions.

The “vulnerable populations” it covers are defined as communities that experience disproportionate cumulative risk from “environmental burdens due to adverse socioeconomic factors, including unemployment, high housing and transportation costs relative to income, access to food and health care, and linguistic isolation; and sensitivity factors, such as low birth weight and higher rates of hospitalization.” “Environmental burdens” include cumulative risks caused by historic and current exposure to conventional and toxic hazards; adverse environmental effects, including environmental conditions caused or made worse by contamination or pollution or that create vulnerabilities to climate impacts; and exposure to hazards made worse by changes in the climate.

Comments –

Though the bill currently says the task force must “discuss… draft rules for agencies”, the rest of it says it is to draft rules agencies must adopt, not just discuss some possible rules.

Details –

The bill specifies the membership of the task force, including representatives of at least eight state agencies; four representatives from different areas of the state who live in communities that are most significantly burdened by, and vulnerable to, high levels of pollution; and a number of other stakeholders. It would be co-chaired by a representative of statewide environmental justice interests and the executive director of the Governor’s interagency council on health disparities. It’s to hold at least four regional meetings in different parts of the state, and complete a report by July 31, 2020.

State agencies must review and revise their rules, programs, plans, and policies every five years to ensure they are promoting reductions in disproportionate environmental burdens and attainment of the environmental health targets the bill establishes, and the task force is to reconvene “five years after the adoption of the last rules to evaluate the findings of each department and update their findings and recommendations.”

The report must discuss:

- Methods to increase public participation and engagement by providing meaningful opportunities for involvement to all people;

- Draft rules for agency adoption regarding cumulative impact analyses that will identify highly impacted communities, based on analyses of vulnerable populations and environmental burdens conducted by the University of Washington’s Department of Environmental and Occupational Health Sciences. (These also include any census tracts that are fully or partly on tribal land.);

- Methods for meaningfully consulting vulnerable populations in periodically evaluating and updating the designation of highly impacted communities and the cumulative impact analysis;

- Methods for creating and implementing analyses to evaluate environmental justice, including but not limited to cumulative impact analyses, into all significant planning, decision making, and investments, including describing potential risks, benefits, and opportunities for these communities and populations;

- Methods for prioritizing these communities and populations by identifying and, where legally and fiscally feasible, maximizing inspection, enforcement actions, investment of resources, planning, permitting, and public participation to reduce environmental health disparities and advance a healthy environment for all residents;

- Methods for cataloging and cross-referencing current research and data for programs within all state agencies relating to the health and environment of people of all races, cultures, and income levels;

- Methods for establishing a qualitative target environmental health level for each county or larger area, and a quantitative target at the census tract level or larger;

- Recommended criteria for identifying and addressing gaps in current research and data collection to inform agency actions, refine cumulative impact methodology, and identify factors that may impede achieving environmental justice; and,

- Methods for incorporating the precautionary approach to decision making, including permitting, to the extent allowed by law.